- 1 Low taxes on

business incomeAlso, the complete absence of personal income taxes makes the UAE attractive for those companies that use human capital as the main business asset.

- 2 Free and

special zonesFree zones allow you to conduct export business without taxes and at minimal cost. Special zones on the mainland of the UAE create a favorable business environment and infrastructure for doing business in certain areas.

- 3 Large seaports

in the UAERightfully, they are world-class transport and logistics hubs, which is of interest to trading and manufacturing foreign companies.

registered in the UAE

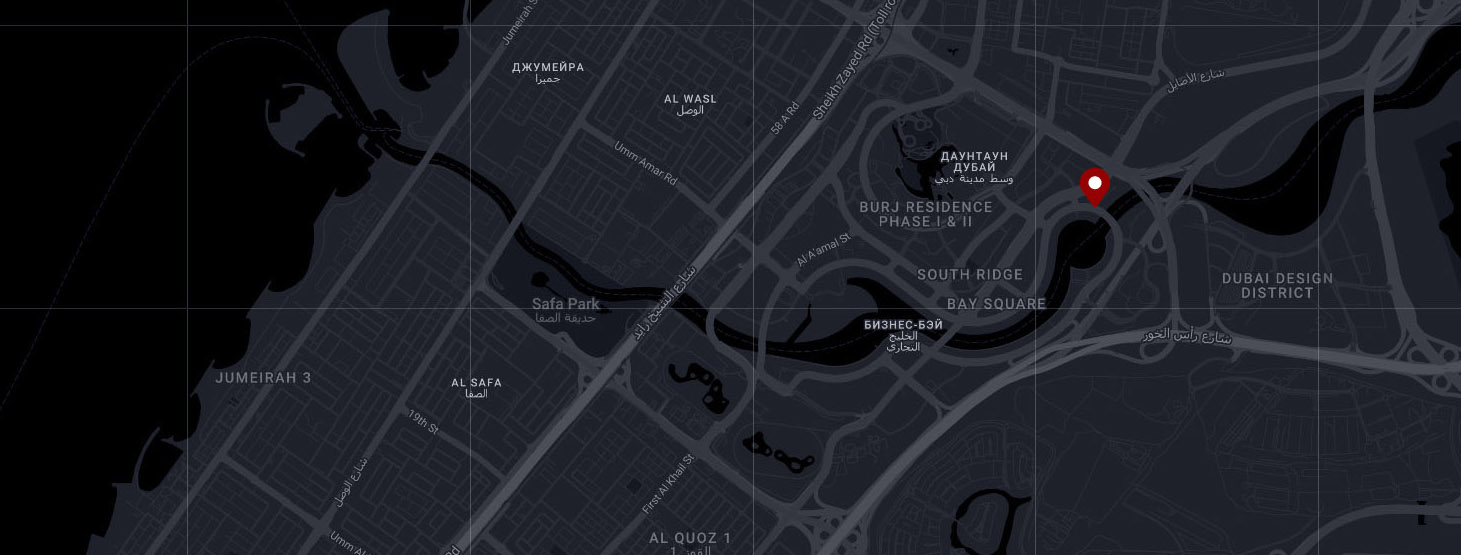

The success of registering an enterprise in the UAE depends on the choice of the most advantageous area for doing business. AGLIO specialists are by your side from the very start, ready to explain and provide support in an understandable language.

-

Companies that are registered in the mainland of the UAE

They allow you to do any business established for the UAE domestic market.. Companies of this type are well-suited for trade, various services to the people and business.

-

Companies registered in special economic zones

Companies of this type operate on the basis of the rules and requirements established by special authorities that control the activities of such special zones. As a rule, special zones unite companies of a specific type of activity (telecommunications, financial sector, trade in precious stones and metals, etc.)

-

Companies registered in free economic zones

Those companies are considered to be based outside the UAE and do not pay taxes on activities carried within such free zones. If such a company sells something to the UAE mainland, then the same rules apply to the transactions as for the import of goods/services, that is goods are cleared through customs before being shipped to the mainland. It makes sense to register a company in a free zone if the activity is export-oriented.

a company in the UAE

- The license is issued for 1 year only, with subsequent annual renewal. When planning a business, you need to take these costs into account.

- The cost of a license for certain types of activities (trade, production) includes % of the annual lease of commercial or industrial premises.

- For companies whose business activities are under the special control of the state, it may be necessary to involve a local partner or a local agent.

- The list of activities to be included in the license is limited. It may be necessary to register several companies if a multifunctional business is planned.

Price of services

– registration of the company name;

– obtaining innitial aprooval to open a company;

– registration of the Memorandum of Assosiation (charter);

– obtaining a business license;

– issuance of a visa and ID card to the investor.

-

Does the citizenship of a certain country of the business owner affect the cost of registering a company in the UAE?

No, the citizenship of the investor does not affect the cost of registration procedures. Citizenship matters only when opening a bank account and completing the compliance procedure (KYC).

-

Does the cost of registering a service and commodity business differ in the UAE?

Yes, it does. Because if there is a store / warehouse, 5% of the cost of the annual lease of the premises is added to the cost of the license. In the service business, the cost of renting a room does not affect the cost of a license.

-

What are the terms of company registration - from the moment of applying to AGLIO?

From 10 days to 30 days. The term depends on the need to find premises for conducting activities.

-

What documents do entrepreneurs need to provide to register a business in the UAE?

A copy of the foreign passport. To register a professional license, you may also need a CV and a diploma to confirm qualifications. To apply for a visa, you will also need a passport size photo in jpeg or pdf formats.

-

Does the cost of registering a company differ in different Emirates?

Yes, it's different. In the northern emirates such as Sharjah, Ras Al Khaimah, Umm Al Quwain and Fujairah, registration fees are 15-20% lower. However, the business activity is also lower, if we talk about the trading business.

Write to us right now

as soon as possible